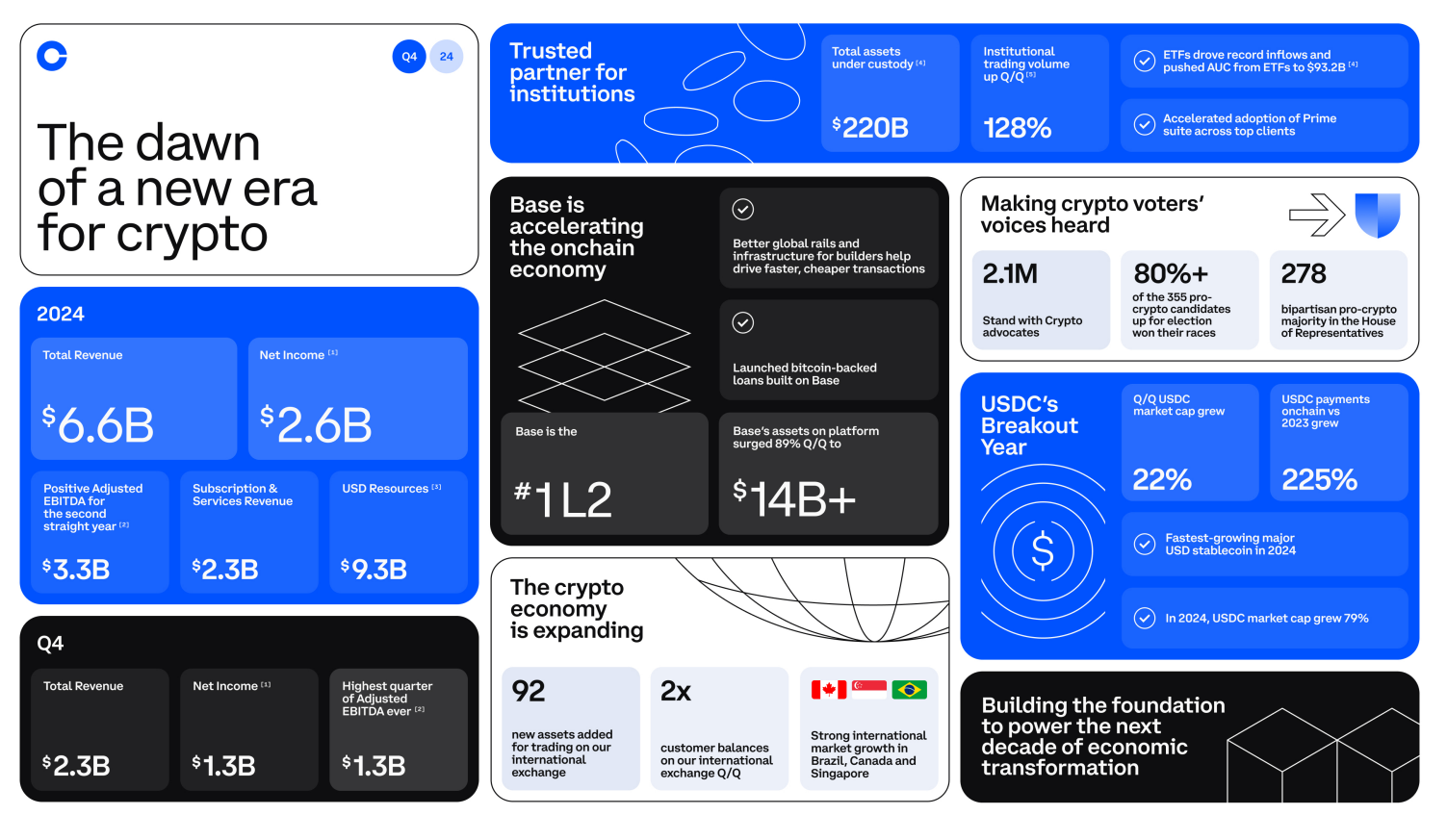

$2.3 Billion Revenue and Global Growth

Coinbase reported nearly $2.3 billion in revenue in its Q4 2024 Shareholder Letter. The firm set ambitious goals for itself, hoping to drive revenue and utility, and its stock price shot up.

Coinbase also opened its report by stating that the Trump administration unlocked “unprecedented” opportunities, and claimed the company will actively work to shape US crypto regulation.

Coinbase Reports Major Financial Success

Coinbase, one of the world’s leading crypto exchanges, is feeling bullish right now. It’s making headway into Argentina and rebuilding relationships in India, opening new markets.

Recently, two meme coins jumped after a listing, dispelling rumors that its listings lost relevance. Today, Coinbase revealed its Q4 2024 Shareholder Letter, and it’s setting ambitious goals:

“It’s the dawn of a new era for crypto. That means it’s time to double down on what we’ve always focused on: building. Our goals in 2025 are to drive revenue, drive utility, and scale our foundations. We believe the opportunity in front of us right now is unprecedented, and that we are well positioned to meet the moment,” it claimed.

Coinbase has good reason to aim high. In its Q4 letter, the exchange boasted $2.3 billion in revenue. Centralized exchanges, in general, had a very profitable quarter, but Coinbase still stands out.

With $1.3 billion in net income, it made over $6.6 billion in total revenue throughout the year. After posting these figures, Coinbase’s stock price jumped as high as 10%.

Coinbase’s Shareholder Letter didn’t only cite bullish market factors, however. It also paid special attention to political considerations.

Brian Armstrong, the firm’s founder and CEO, has been taking active efforts to reach out to President Trump. He even proactively signaled his willingness to comply with possible new crypto legislation. This is already paying dividends.

The exchange has been at war with the FDIC over Operation Choke Point 2.0, and its fortunes here have dramatically changed. Since Trump sent his Crypto Czar to investigate possible foul play, the federal government has taken the allegations very seriously.

Last week, Coinbase’s CLO testified on it before Congress, which would’ve been far-fetched a few months ago.

Of course, Coinbase’s Shareholder Letter didn’t dive too deep into this relationship; it merely praised Trump in the first few sentences.

The report mainly covered company fundamentals: revenues, expenses, future projects, etc. However, it paid special attention to US regulation, claiming that Coinbase will actively work to shape it. As of now, that goal looks very achievable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.