Bitcoin, Ethereum Trail While Market Picks Up

Key Takeaways

Bitcoin and Ethereum have seen their market valuations drop by more than 18% since Nov. 10.

Now, one technical indicator presents a buy signal on their 12-hour charts.

BTC could rise to $60,000, while ETH could return to $4,500.

Share this article

Bitcoin and Ethereum have faced substantial price drops over the last nine days. While investors are showing signs of fear, one indicator suggests that a significant rebound is underway.

Lower Caps Bounce Back

Volatility has struck back the cryptocurrency market, sending many investors into a state of “fear” for the first time since September.

Bitcoin crashed below $60,000 Wednesday, helping cause more than $600 million worth of long position liquidations over the past four days. The downswing spilled across the entire cryptocurrency market and generated significant losses. Still, many lower cap assets shrugged off the uncertainty.

Several Metaverse tokens, including Decentraland’s MANA, Enjin Coin’s ENJ, and The Sandbox’s SAND, have fully recovered from the recent pullback and are showing bullish momentum. Meanwhile, Elrond’s EGLD and Avalanche’s AVAX recently reached new all-time highs.

While Bitcoin and Ethereum have been in recline this week, lower cap assets are in the spotlight. Nonetheless, a technical indicator flashing a buy signal for the two leading cryptoassets suggests that they could soon catch up with the rest of the market. The bullish formation anticipates a swift rebound that could put the bears under pressure.

Bitcoin, Ethereum Present Buy Signal

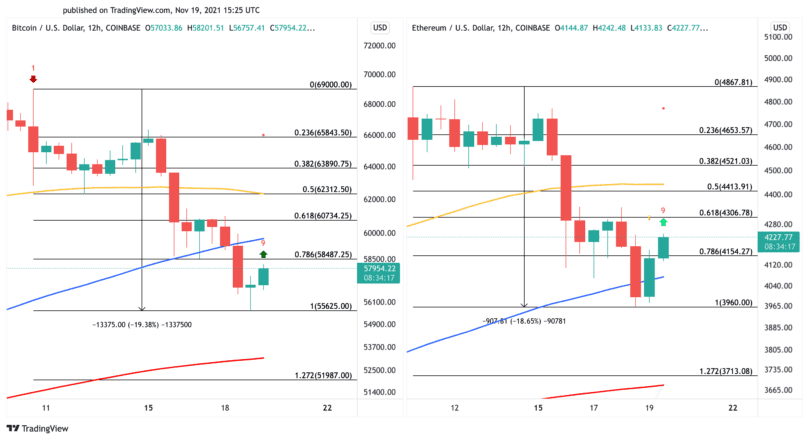

The Tom Demark (TD) Sequential indicator has presented a buy signal on both Bitcoin’s and Ethereum’s 12-hour charts. The bullish pattern came after both cryptocurrencies saw their market valuation drop by more than 18% since Nov. 10. Now, the TD forecasts that BTC and ETH could enter a one to four 12-hour candlestick upswing before the downtrend resumes.

A spike in buying pressure that pushes Bitcoin above $58,500 could send prices to the 100-twelve-hour moving average at $60,000. A sustained 12-hour candlestick close above resistance level could extend the rebound toward the 50-twelve-hour moving average at $62,300.

Likewise, Ethereum needs to overcome the $4,300 resistance level to advance toward the 50-twelve-hour moving average at $4,500. If if it overcomes this hurdle, ETH could advance to $4,653.

It is worth noting that Bitcoin and Ethereum must hold above their respective swing lows to avoid further losses. If BTC breaks below $55,600 and ETH loses $3,960 as support, the downtrend could be primed to resume. Bitcoin could fall to $52,000, while Ethereum could drop to $3,700.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

VanEck Bitcoin Futures ETF Will Debut on Cboe

The latest Bitcoin futures exchange-traded fund (ETF) from VanEck is set to go live on the Cboe BZX Exchange on Nov. 16. VanEck’s Bitcoin Futures ETF To Be Listed Tomorrow…

Tether Subsidiary Synonym Will Build Tools for Bitcoin, Lightning

Synonym Software, a blockchain software company owned by the popular stablecoin firm Tether, was founded today. Synonym Software will create tools for Bitcoin and the Lightning Network, with two initial…

Brave Introduces Built-in Browser Wallet for Ethereum

The latest update to Brave Browser (version 1.32) now offers a native wallet for the Ethereum ecosystem. Brave Introduces Native Ethereum Wallet In a Tuesday press release, the team announced Brave Wallet…

What is Rarible: A DAO for NFTs

What was once dismissed as a silly and expensive sector, NFTs give creators access to global markets in a way that’s never been possible before, and it’s all thanks to blockchain.Those familiar…