Bitcoin Price Nears $110,000 on Long Term Holder Maturity

Bitcoin has experienced a week of indecisive price action, leaving investors uncertain about the market’s direction.

Despite this stagnation, historical trends in investor behavior suggest a rally could still be on the horizon, defying expectations based on price alone.

Long-Term Holders Keep Bitcoin Grounded

The long-term holder (LTH) net unrealized profit/loss (NUPL) indicates that investors who bought Bitcoin in December 2024 are maturing into LTHs, which requires a 155-day holding period. This is positive for Bitcoin because maturing buyers often hold coins longer, reducing impulsive selling pressure.

When more investors become LTHs, coins tend to stay in strong hands, which builds resilience against price dips. This behavior could support Bitcoin’s price stability and potentially drive gains as the market matures and short-term volatility diminishes.

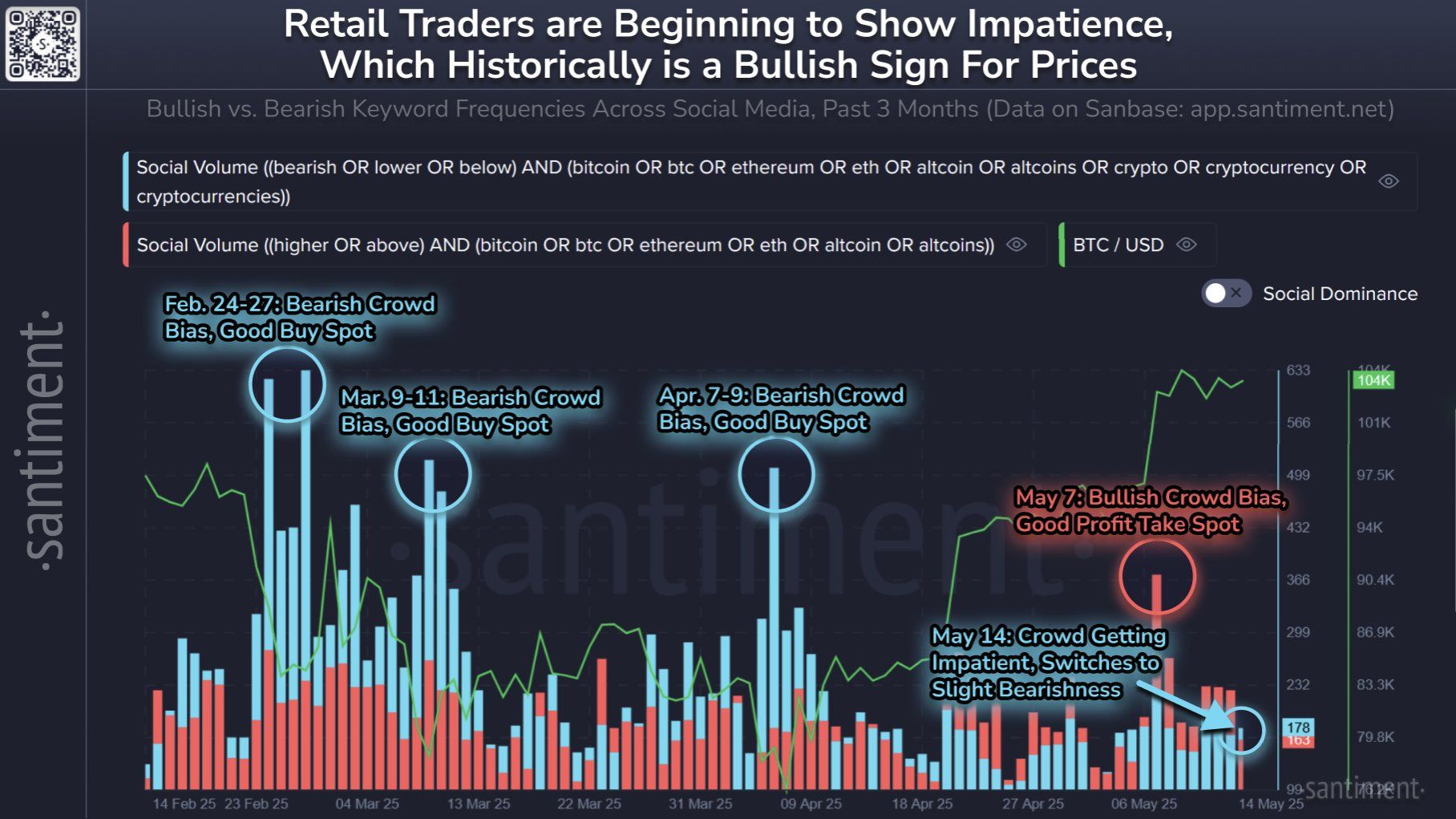

Bitcoin investors’ sentiment often moves contrary to market performance. Historical data shows bearish crowd sentiment typically signals a buying opportunity, while excessive bullishness precedes sell-offs. Over the past 48 hours, sentiment has shifted toward bearishness again.

This increased fear among retail investors could set the stage for a market rise, as traders look for value during dips. The growing apprehension contrasts with the positive price fundamentals, suggesting a potential breakout fueled by renewed buying interest amid caution.

BTC Price Needs To Breach Past A Key Barrier

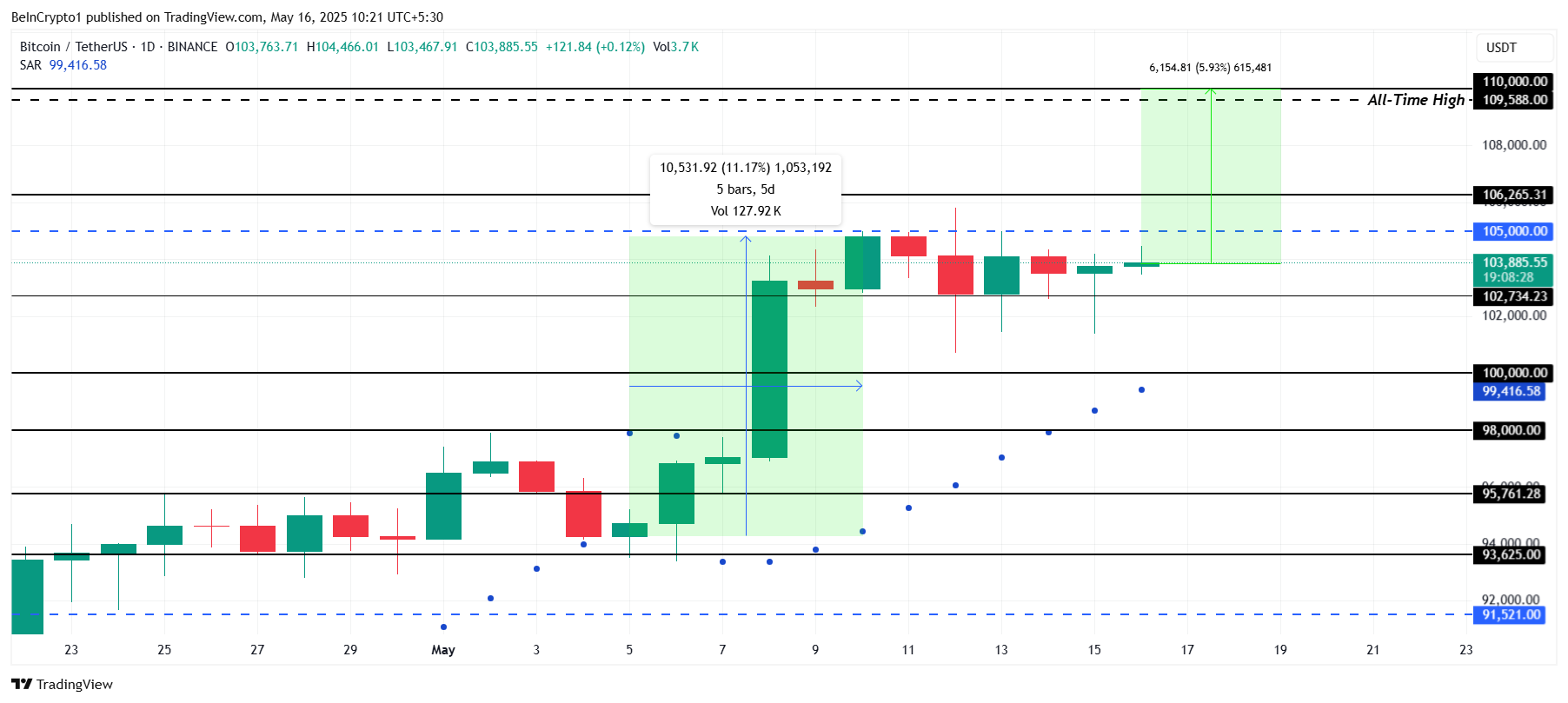

Bitcoin is currently trading at $103,885, moving sideways within a range between $105,000 and $102,734. To reach $110,000, Bitcoin needs to rally nearly 6%, which is achievable given recent momentum.

Last week, Bitcoin surged 11% in just five days, showing strong potential for upward movement. The key resistance after $105,000 lies at $106,265. Successfully flipping this level into support would likely confirm a push toward $110,000 and possibly a new all-time high.

However, if Bitcoin continues to consolidate sideways, impatient investors might sell to avoid losses. This selling pressure could drive the price below $102,734, potentially dropping toward $100,000 and invalidating the bullish outlook for now.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.