Mitsubishi UFJ Set to Launch Stablecoin Platform

The Japanese banking giant Mitsubishi UFJ says it will launch a cross-chain stablecoin issuance and interoperability platform next year.

In an official Mitsubishi UFJ announcement, the firm stated that it would work with a Tokyo-based company named Datachain to “build cross-chain infrastructure for stablecoins.”

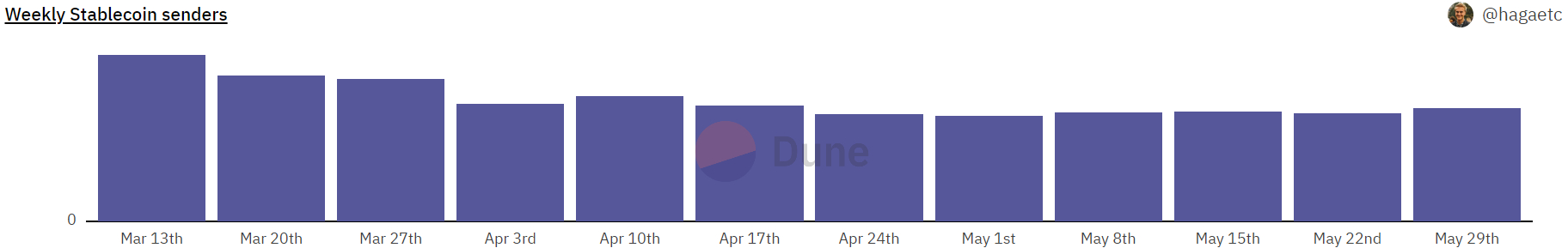

Mitsubishi UFJ began piloting the project back in March.

A company named Toki, which is based in Dubai, will “establish a liquidity pool” for each of the blockchain networks the platform handles.

The companies said that they would develop a “stablecoin issuance management platform” named Progmat Coin.

“Target public blockchain networks” for the platform “include Ethereum, Cosmos, Avalanche, and Polygon.”

But the companies said they “plan to expand to other blockchain [networks] in the future.”

The move comes just days after a new stablecoin-related legal amendment came into force in Japan.

The amendment effectively lifts a long-standing ban on stablecoin issuance for Japanese firms.

Several trust banks are thought to be keen to launch stablecoins as a result.

And many think these coins could be used in international trade.

Mitsubishi UFJ has previously unveiled plans to release a coin of its own.

But in more recent months, the bank has focused on blockchain interoperability solutions.

As Japanese banks have begun drawing up their stablecoin plans, they appear to be making use of various blockchain solutions.

Without a bridge-type solution, this could mean that inter-network transactions could prove problematic.

Mitsubishi UFJ’s Stablecoin Interoperability Project – Not Just for Japan?

The Mitsubishi UFJ-led project is not just for domestic use, the firms claimed.

They spoke of launching a “cross-chain bridge that can be used globally.”

The companies said they were aiming to launch the platform “in the second quarter of 2024.”

And the bank added that the platform would have stablecoin issuance functions.

The companies say the platform will allow for cross-chain swaps, lending, and payments.

The firms also hope to create issuance options for non-fungible tokens (NFTs), as well as security tokens.

In Toki’s own release, the firm wrote of the development:

“This marks a significant milestone in integrating Japanese real world assets into the crypto sphere. Exciting times ahead.”