Despite Volatility, Bitcoin Still Looks Strong

[ad_1]

Key Takeaways

Bitcoin has remained somewhat stagnant in recent weeks, fluctuating between $60,000 and $63,600.

Transaction history shows that support is significantly larger than resistance.

Such market conditions suggest that a bullish breakout might be underway.

Share this article

Bitcoin has shaken some of the so-called “weak hands” out of the market as it continues to trade within a tight price pocket with no clear direction. Still, on-chain data show that the odds favor the bulls.

Bitcoin Holds on Stable Support

Market participants appear to be growing impatient as Bitcoin has remained stagnant over the past two weeks.

The flagship cryptocurrency has been mostly consolidating between $60,000 and $63,600 since Oct. 21 without providing any clear signals of where it will head next. Regardless, transaction history shows that BTC sits on top of stable support and below a thin resistance barrier.

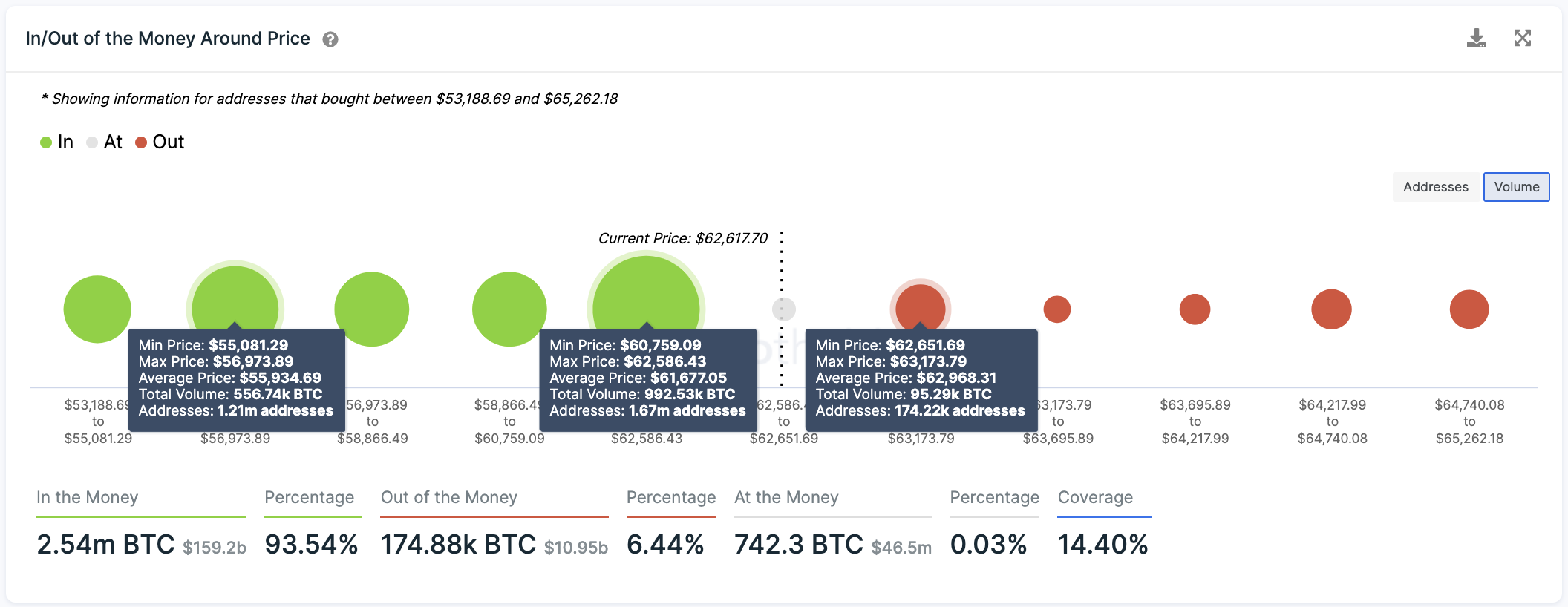

Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, bears would have a difficult time pushing prices lower despite the ongoing consolidation. More than 1.67 million addresses have previously purchased nearly 1 million BTC between $60,760 and $62,590.

Such a significant demand wall could absorb any spike in downward pressure as holders might do anything to prevent their investments from going “Out of the Money.” They may even buy more tokens at every downswing, which could help propel Bitcoin higher.

The IOMAP cohorts also show nothing that might impede the pioneer cryptocurrency from re-entering price discovery mode if buy orders pile up. Based on the recent price action, the only considerable area of resistance ahead of Bitcoin appears to be at $63,600.

While transaction history does not show much supply around this price level, a decisive daily candlestick close above it will all but confirm a potential upswing to a new all-time high.

It is worth noting that despite the significance of the demand wall that lies underneath Bitcoin, investors must be prepared for any FUD (fear, uncertainty, and doubt) event that might put the bullish outlook on hold. A substantial spike in selling pressure that pushes BTC below $60,760 could result in a correction.

Under such unique circumstances, the bellwether cryptocurrency might drop toward $56,000.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Miami Mayor Will Accept Next Paycheck in Bitcoin

Miami mayor Francis Suarez has committed to taking his next paycheck in Bitcoin along with other city workers. Suarez Will Be Paid in Bitcoin In a Twitter comment today, Suarez…

MDEX: Overlooked Decentralized Exchange That Pays You to Trade

Based on statistics from DeBank and dapp.com, one of the top-performing decentralized exchanges by TVL and trading volume this year is MDEX—an AMM-based DEX functioning across the Huobi Eco-chain (HECO), Binance Smart Chain…

El Salvador Will Use Bitcoin Profits to Build New Schools

The construction of the buildings is planned as part of El Salvador’s Mi Nueva Escuela education program. El Salvador Building Schools With Bitcoin Gains El Salvador is planning on using…

Peter Thiel Calls Bitcoin Surge Sign of a “Crisis Moment”

At an event on Sunday, Peter Thiel, the co-founder of PayPal and Palantir Technologies, claimed that Bitcoin’s sharp rise was a sign of the ongoing rise in inflation. Thiel Suggests…

[ad_2]

Source link