Yield Farmers are Migrating to Polygon

[ad_1]

Key Takeaways

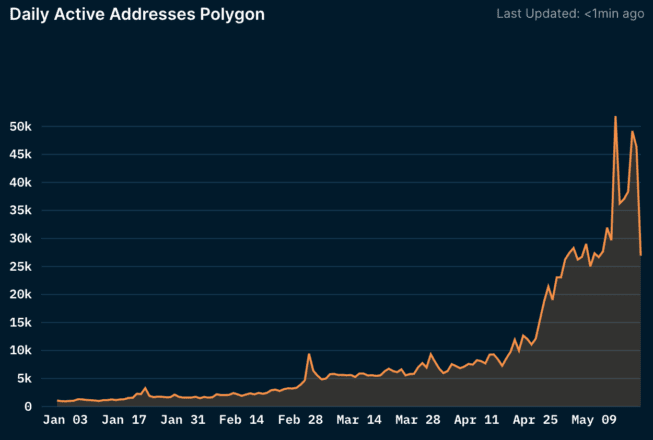

The number of daily users on Polygon is growing fast, with the Layer 1 scaling solution recently surpassing Ethereum in the number of daily transactions.

Ethereum-native protocols such as Aave, SushiSwap, and Curve led the way for Ethereum users to migrate to the network.

Polygon is an Ethereum scaling solution and is in direct competition with Binance Smart Chain.

Share this article

Polygon offers a similar yield farming experience to Ethereum mainnet at a fraction of the cost. Key metrics show that DeFi power users are starting to migrate to the network.

Low-Cost DeFi on Polygon

High gas fees are pricing regular investors out of DeFi on Ethereum. As the price of ETH has risen, gas fees have also surged, casting doubts over the possibility of a second DeFi summer.

Ethereum’s popularity has helped drive gas prices to record highs even with organizations like Flashbots working to reduce blockchain congestion. Some users have turned to Binance Smart Chain, though that network has suffered from a variety of issues such as hacks and flash loan attacks.

In the search for low fees and fast transactions, many yield farmers have turned to Polygon, the Ethereum scaling solution that’s sometimes described as a “commit chain.” Polygon uses a Proof-of-Stake consensus algorithm, and transactions on the network cost fractions of a cent.

The growth in the number of daily active addresses has been accompanied by an impressive rise in the price of Polygon’s native token, MATIC. Over the last 30 days, the token price has increased by more than 300%, according to CoinGecko. The number of transactions on Polygon also surpassed Ethereum for the first time on May 2, with leading exchange Quickswap accounting for most of the volume.

Let’s dig into some @0xPolygon data on @nansen_ai (currently in alpha). Looks like its flipped eth based on number of transactions on May 2nd. pic.twitter.com/pzJDdFCtfV

— Akshay (@aioeth) May 7, 2021

According to Nansen, less than 0.1% of Ethereum addresses have interacted with Polygon, which has meant there are bountiful yield farming opportunities for those who have started using the network. The chance to earn passive yields has increased as more protocols have launched on Polygon.

While apps like Quickswap are Polygon-native, interest in the Layer 1 scaling solution grew when established DeFi protocols set up versions of their apps on Polygon. Aave, Curve, and SushiSwap have all joined the ecosystem this year, with positive results.

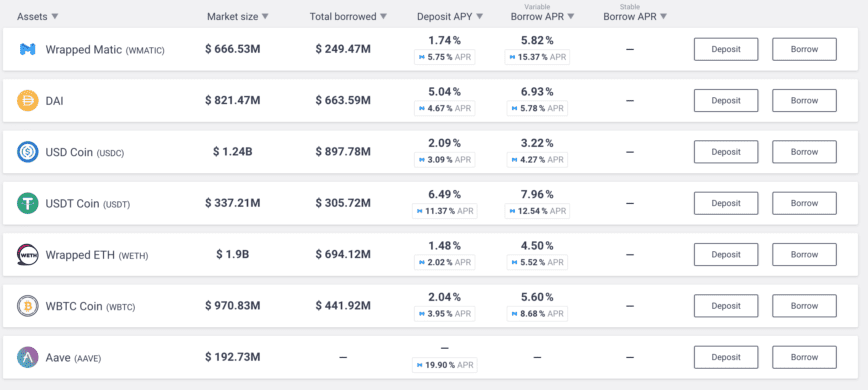

Even after the launch of Aave v2 and a popular liquidity mining program on Ethereum, Aave’s Polygon market size has already reached $6 billion. To help the market grow, Polygon has distributed MATIC rewards for lenders and borrowers. The demand for low-cost DeFi, easy access to capital, and the MATIC rewards distributed to lenders and borrowers have all helped attract liquidity.

Lenders can currently earn up to 18% lending USDT on Aave. Interestingly, users can also borrow USDT at a rate of 8% per year but earn 12.5% in MATIC rewards, resulting in a net gain.

Yield Farming on Polygon

DeFi users currently have several options for earning high yield on crypto assets on Polygon. The first possibility is to provide liquidity on Quickswap, the most popular exchange on Polygon. With low fees and gas prices, Quickswap’s volume is high and results in high commissions for liquidity providers (LPs). In addition, LPs can receive QUICK rewards on certain pools, further boosting APYs. These rewards currently range from 30% on stablecoin pairs to 200% when the trading pair includes QUICK. SushiSwap and Curve are also offering MATIC rewards on top of fees for their LPs.

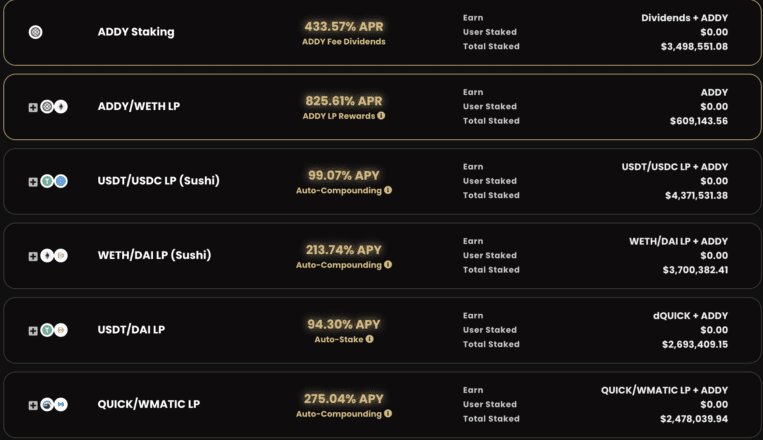

Users can also choose to entrust their LP tokens (tokens received when providing liquidity to a trading pair) to yield aggregators like Yearn.Finance on Ethereum. These yield aggregators help reinvest profits in the same pools, boosting the returns of their users. Some platforms such as Adamant Finance have also launched their own governance token as a further incentive, driving APYs even higher. As a result, providing LP tokens for Sushi’s USDT/USDC pool is currently earning a 99% APY, including ADDY tokens.

Classic yield farms are back as well, the most popular so far being Polywhale. Users can stake their cryptocurrencies in Polywhale’s pools in exchange for its native token KRILL. When users deposit their crypto assets, a portion of their deposit is used to repurchase KRILL from the market. Users can currently earn up to 80% APY by staking MATIC, harvest the KRILL rewards, and deposit them in their own pool for up to 2,500% APY.

It’s important to note that such farms are highly experimental, and the price of tokens like KRILL can be extremely volatile. For many users, the mix of risk and huge returns recalls the summer of 2020 on Ethereum. If the excitement around DeFi yield farming returns this summer, it may well be on Polygon.

Disclaimer: The author held BTC, ETH, and several other cryptocurrencies at the time of writing.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Aave Will Build on Polygon’s Scalable Layer 2 Platform

Decentralized lending platform Aave says that it will scale its DeFi platform beyond the Ethereum blockchain by also joining several sidechains, including Polygon. Aave Explores Polygon According to Aave, Ethereum’s…

Polygon Launches $40M Liquidity Mining Program with Aave

Polygon is launching a liquidity mining program with hopes of attracting liquidity to its network. Polygon Rewards Liquidity Miners Polygon, one of Ethereum’s most vital scaling solutions, is launching a…

What Are Non-Fungible Tokens (NFTs)?

Tokenization is well-suited for commodities like fiat currencies, gold, and physical land. A fungible asset’s representation on blockchain makes commodities tradable 24/7 via borderless and frictionless transactions. Fungible goods are…

Polygon Transactions Explode After DeFi Expansion

Polygon’s on-chain activity suggests exponential growth over the last month, largely driven by DeFi projects expanding to the platform. Polygon Experiences DeFi Growth As Ethereum faces scaling issues and high…

[ad_2]

Source link